The Child Tax Credit Will Cut Child Poverty

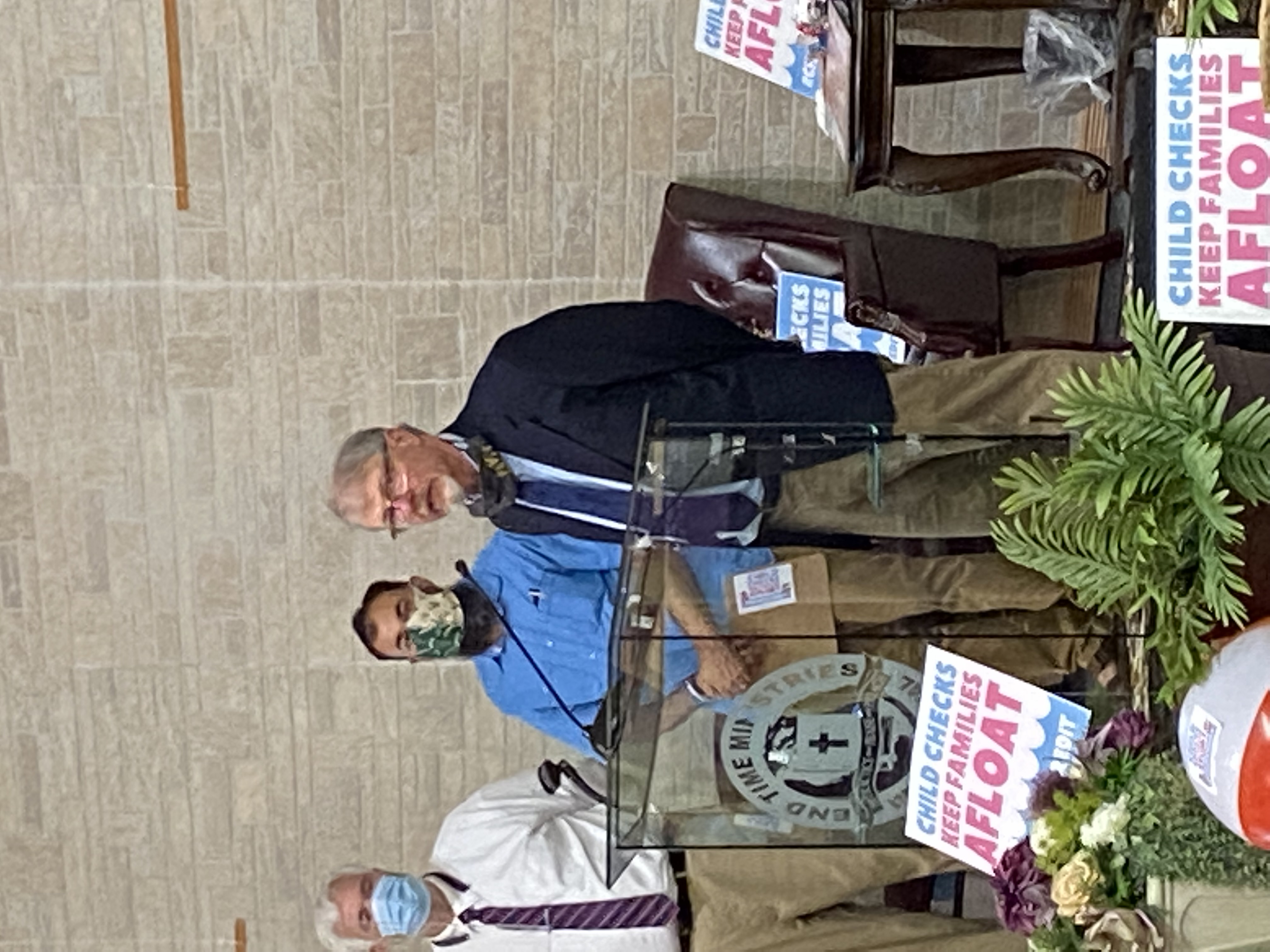

The Wisconsin Council of Churches joined with other allies who were a part of the End Child Poverty Coalition (WISDOM, Wisconsin Council of Churches, Kids Forward, and Citizen Action of Wisconsin) and with the Economic Security Project, Worker Center for Racial Justice, and Community Advocates Public Policy Institute to hold four news conferences in Appleton, Eau Claire, Madison, and Milwaukee on Thursday, July 8 and Friday, July 9 to tout a brand new and historic $300 per child tax credit that Wisconsin families will soon be receiving monthly. The hope is to build support for making the Child Tax Credit permanent. This historic expansion will cut child poverty nearly in half (45%) in Wisconsin and will benefit 90% of Wisconsin kids (over 1.5 million kids).

“Communities of faith must advocate for extending the expanded Child Tax Credit. We must make the case with all the power and passion that we can muster that this is not just another public policy, it is a compelling moral obligation,” says WCC’s Justice and Witness Coordinator, Peter Bakken. “Our God’s intent is that good, healthy and supportive relationships be made real in our communities, and as we look to the high rates of childhood poverty- it is not good and we know we are far from the creator’s intent”, said Marian Boyle Rohloff, the President of WISDOM. “It is important to have the child tax credit and have this be permanent because it helps put food on the table, trips to the dentist, savings for education, the child tax credit will help sustain health and wholeness for families and all our children.“

“We are called to a movement of compassion and transformation,” said Rev. Kathryn Reid Walker, Pastor of 1st Presbyterian Church in Eau Claire. “We are called up to act in ways that provide health, housing, and wholeness to all citizens so parents don’t have to worry about how they will feed their children and children can rest safely sheltered every night.”

From mid-July through December 2021, families in your congregation and community will begin

receiving monthly payments of up to $300 per child from the expansion of the Child Tax Credit that

was included in the American Rescue Plan.

Anyone who qualifies and has filed a tax return will receive the Child Tax Credit automatically. If the

amount of their credit exceeds the amount of tax they owe, they will receive all or part of it as a direct

payment. Even if someone doesn’t have any income to report, or hasn’t filed a tax return, they can

receive the credit by using the IRS “non-filer sign-up” web portal.

But many families in your congregation or community – especially those with little or no income — are

unaware of the Credit and may miss out. Church staff and volunteers who help out with service and

outreach programs (food pantry, homeless shelter, counseling services, etc.) can help members of the

congregation and the community access the expanded Child Tax Credit.

The first place to go to find out more about the credit and how to apply for it is childtaxcredit.gov on

the White House website. It includes:

- Information about the expanded Child Tax Credit, with frequently asked questions about eligibility, payments, etc., and

- A link to the non-filer sign-up portal,

- The IRS Child Tax Credit information page (available in several languages),

- A downloadable two-page explainer.

- A link to estimates of the number of children in each zip code who may miss out because the household hasn’t filed a tax return (which could inform your outreach efforts).

Information to share:

The Child Tax Credit Toolkit | The White House

- In Spanish: El Crédito Tributario por Hijos Kit de Herramientas | La Casa Blanca (whitehouse.gov)

- Videos from HealthWatch Wisconsin that explain the IRS tools to help families:

- Determine if they are eligible for the credit (Child Tax Credit Eligibility Assistant)

- Register to claim the credit if they are unknown to the IRS (Non-Filer Sign Up Tool)

- Opt out of the advance payments (Child Tax Credit Update Portal)

And how the credit relates to other benefits people might be receiving: Impact of the Child Tax Credit on SSI – YouTube

Resources if you want to help hard-to-reach people access the Child Tax Credit:

Additional resources

- The Child Tax Credit and Mixed Immigration-Status Families | CLASP – with information helpful to others as well

- What’s New about the Child Tax Credit in 2021? – Get It Back (taxoutreach.org) – answers to many questions about the credit, including how it differs from the pre-American Rescue Plan Child Tax Credit, overpayments, shared custody, tax filing, etc.